Stable by design, profitable by nature

HedgeUSD is the first stablecoin built with yield at its core by controlling the hedge mechanism.

Its initiative brings three key breakthroughs: stability that earns automatically, a transparent protocol governed by its own synthetic currency, and a sustainable model that eliminates dependence on risky external farming. By uniting stability, growth, and governance in one design, HedgeUSD delivers a new standard for digital money.

Stabilization utility for DeFi protocols

Price-fetched mechanism

The mechanism anchors its value by continuously referencing trusted internal oracles. These decentralized feeds ensure HedgeUSD stays pegged, while the protocol automatically adjusts supply and hedge-bearing yield to maintain stability.

Hedge-powered functions calling

Risk controller engineering

It employs a built-in risk controller that continuously balances stability and yield. By monitoring collateral levels, market volatility, and liquidity flows, the protocol automatically adjusts parameters to safeguard the peg and protect stakeholders.

Distribute yields in an automated manner

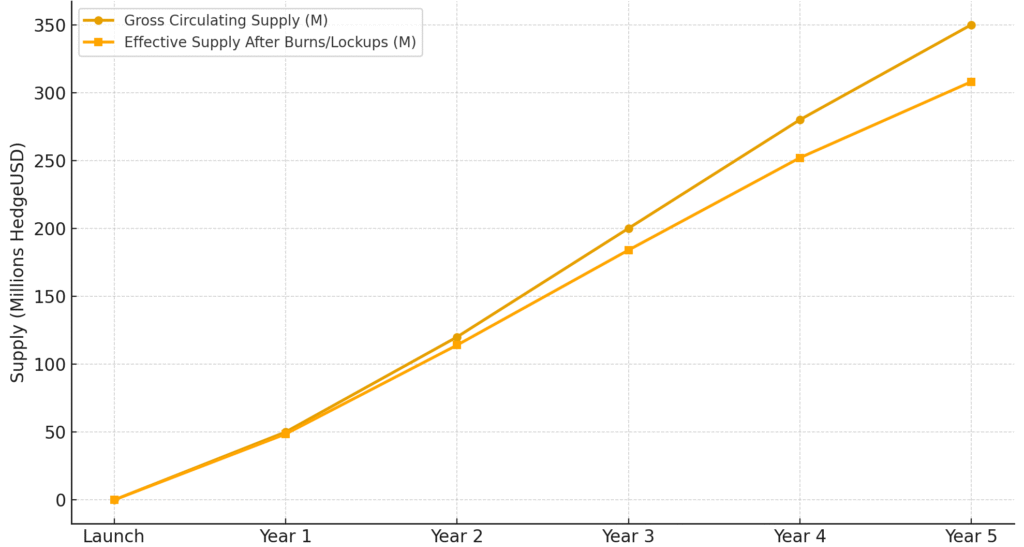

Yield-bearing scalability

HedgeUSD is designed to scale yield automatically as adoption grows. The protocol channels activity and liquidity into its hedge-bearing model, so every new participant strengthens the system’s capacity to generate returns.

Advisory team

A team of professional advisors with impressive experiences and backgrounds in financial and technology industries.